![]()

Nature 426, 689 (11 December 2003); doi:10.1038/426689

San Diego

KEN HOWARD

|

|

|

Cover |

In just a few decades, San Diego has changed from a sleepy military town, known mainly for its great surfing beaches, into one of the fastest-growing high-tech centres in the world. Following hot on the heels of the more mature San Francisco Bay Area and Boston regions in the United States, and giving sites in Canada, Europe and Asia a run for their money, San Diego provides an interesting lesson in how a high-tech hub takes root and expands.

In this Nature Outlook, we explore the factors that have shaped its success. The most important, and yet perhaps the most difficult for other regions to emulate, is San Diego's legendary 'brain trust'. The tradition of excellence at academic centres such as the University of California, San Diego, the Salk Institute for Biological Sciences and the Scripps Research Institute has provided a solid foundation for the start-up companies that have put San Diego on the map. For instance, information about cellular signaling pathways, painstakingly deduced by graduate students, postdocs and faculty members, has been used to develop drug targets. Fresh approaches suggested by physicists for beaming data through the air have led to new forms of wireless communication and enhanced the region's already strong reputation for telecommunications.

Once the seed of a new technology has been given life in the laboratory, San Diego-based venture capitalists and entrepreneurs are extremely active in aiding the next key step. They provide the financial backing necessary to see if the technology will yield a marketable application and they help new companies to commercialize promising technologies.

Although discovery and commercialization occur across the globe, most of the world's newest companies and products can trace their roots to just a few high-tech hubs. San Diego belongs to this group, and its famous networking environment has helped to build up a high level of investment in its own companies. The next challenge will be to ensure a steady stream of investment from around the world, to increase the diversity of revenue, and to keep the high-tech sector strong in this lean financial climate.

We are grateful for the support of all our sponsors, particularly Pfizer, as a result of which all content is available free online until March 2004 with free reprints of this supplement circulated to all Nature Reviews and most Nature research journal subscribers. As always, Nature carries sole responsibility for all editorial content.

Nature 426, 689 (11 December 2003); doi:10.1038/426689

Good neighbours

ERIC NIILER

Eric Niiler is a correspondent for KPBS radio in San Diego.

A tight-knit community and a cooperative spirit has helped San Diego to succeed. Eric Niiler checks out California's rising star.

|

ROGER HOLDEN/BLACKBOOK STOCK |

|

Connected: San Diego's research network has allowed it to flourish as a high-tech hub. |

Large-scale business success tends to conjour up images of a sprawling metropolis — huge areas of industrial activity linked by lengthy highways to financial hubs and disparate research institutions.

But for one rising star in the US business firmament the opposite is true. In fact, many cite San Diego's densely packed research community as a major reason for its success as a high-tech and biotech hub. Biotechnology research, for example, is located along a densely packed two-mile stretch of North Torrey Pines Road that features institutions such as the University of California, San Diego (UCSD), the Scripps Research Institute and the Salk Institute for Biomedical Studies.

"We can throw a rock and hit UCSD," says Polly Murphy, vice-president for technology management at the Salk Institute. "I can hit a golf ball and hit Scripps. Everything is within walking distance. That means more heads get together and we do a lot of collaboration."

This open attitude has helped the region to brush off the effects of economic recession in the early 1990s to become the third in terms of the number of biotech companies in the United States behind the San Francisco Bay Area and Boston (see map). But this success has come at a price — San Diego is running out of land for development and is facing escalating house prices. As a result, some technology firms are beginning to look elsewhere to build their new facilities. But with a high influx of federal funds, the region looks unlikely to relinquish its status just yet.

High-technology and biotechnology clusters don't grow overnight. Each follows its own long-term formula for success, usually backed by the presence of outstanding universities, a healthy flow of government research money, and venture capitalists prepared to fund start-up firms.

The cluster in San Diego is no exception, although its rapid rise has attracted the attention of scientists, entrepreneurs and policy-makers worldwide, who are keen to emulate its success in their own cities.

|

|

Strength in diversity

|

SOURCE: ALEXANDER X

|

|

Who works where: the number of employees across San Diego's technology sector in 2003. |

Today, one in eight San Diego workers is employed in the technology cluster, a broad category that includes the biotechnology, life-science and medical-device sectors, telecommunications and electronics firms, computer companies and military-related tech firms. In 2003, San Diego biotech companies reported a collective $1.8 billion in revenue and had nearly 200 products in development, according to BIOCOM, the local biotech industry organization.

San Diego began its transformation from a tourist and military town into one of the world's most innovative high-tech regions after a crippling recession in the early 1990s, which hit as a result of cuts in US military spending as the cold war dwindled. This led to the loss of some 60,000 jobs, but the region has managed to avoid the massive job losses in other areas during the more recent tech decline. Many other tech-dependent regions — such as the San Francisco Bay Area — continue to suffer economic headaches following the collapse of the dotcom bubble in 2001–02. Despite contractions in some fields — notably telecoms — overall employment in San Diego's tech sector has risen steadily from 99,377 in 1995 to 162,251 this year, according to Alexander X, a publisher based in San Diego that tracks such employment in California (see chart). It achieved this partly by balancing biotech with high-tech — the wireless, software and telecoms sectors have seen reduced profits over the past two years, but biotech has grown.

Another factor is that San Diego-based companies and universities have received $1.4 billion in new defence research and development contracts since 2001 for counter-terrorism R&D. High-tech communications software and biodefence research are now priorities for the US government. Fortunately for San Diego, which suffered significant job losses in the defence sector in the early 1990s, it already had the infra-structure in place to meet the new challenges. "We've been saved because of our diversity," says Kelly Cunningham, an economist and research director at the San Diego Regional Chamber of Commerce.

Biotech boost

Nowhere is San Diego's resurgence more obvious than in biotechnology. The city designated the 50-square-kilometre Torrey Mesa region as a zone for research and industry in the early 1960s, and since the first biotech firms were set up in the late 1980s, dozens of academic scientists have taken their ideas to nearby technology companies or started up their own.

Since 1990, for example, UCSD has produced 69 biotech and high-tech firms, which currently earn the school $17 million per year in licensing fees. The Salk Institute has launched 17 companies since the late 1980s, and researchers at Scripps — one of the largest non-profit research institutes in the United States — have developed 40 companies over a similar period of time.

Despite its rapid growth, many inhabitants maintain that San Diego still feels like a small town, living in the shadow of Los Angeles two hours' drive to the north. It is off the beaten track, which means that researchers and business people feel that they must share ideas and sometimes even office space.

BIOCOM has been important for promoting such informal networking. This has been particularly true for young tech entrepreneurs looking for experienced mentors who have already gone through the boom-and-bust cycles of the technology industry, says Bob Slapin, executive director of the San Diego Software Industry Council.

"The biggest difference between San Diego and other regions is a support structure and experienced individuals who are willing to assist companies," Slapin says. BIOCOM, for example, has set up joint purchasing contracts with a variety of suppliers so that a group of small biotech firms can save money by making bulk orders of specialized equipment or services such as compressed gas, lab equipment, insurance and cleaning services.

|

|

Networking and informal get-togethers have also led to a 'cross-pollinization' of new technologies. For example, a blend of genomics and computational modelling has led to the evolution of several hybrid firms. Cengent Therapeutics is using three-dimensional technology originally designed to spot military targets to identify possible drug-delivery locations. "These are crossover technologies that lead from software to biology," says Fred Cutler, former head of UCSD CONNECT, an arm of the university that helps to develop and foster start-up technology firms.

Such opportunities have also proved attractive to the pharmaceutical industry. Several big drug firms have expanded their research divisions into San Diego because of the cluster of biotech talent hat exists there. Pfizer opened a new 70,000-square-metre research centre in May 2002 to study AIDS, diabetes and cancer. Novartis, Johnson & Johnson, Merck and Elan have all established West Coast research hubs in San Diego in recent years, providing more jobs in the area.

|

Cash rich

But if networking and cross-fertilization are driving San Diego's success, then oiling the wheels is the high level of funding available to the region. In 2002, San Diego's entire technology sector received $1 billion in private venture-capital funding. And in a report by the Brookings Institution, the city — along with Raleigh-Durham and Seattle, two other successful biotech clusters — was identified as receiving an average of $500 million annually from the National Institutes of Health (NIH) during 1990–2000 and at least $700 million in private venture-capital funds from 1994–2001.

San Diego's success at attracting such high levels of funding can largely be attributed to its proactive approach. UCSD CONNECT, for example, was set up in 1995 to help start-up companies obtain financial back-up. It has subsequently initiated a series of scientist-to-business forums that to date have helped technology companies raise more than $5.8 billion. The various institutions in the region agree that their active solicitation of ideas from their own faculty members has also helped to bring money into the area.

"We try to make them understand that their duty is to do more than just make a discovery and publish a paper," says Alan Paau, assistant vice-chancellor at UCSD and director of the school's technology-transfer programme.

|

|

Although San Diego produces a large number of science graduates, helping to fuel its culture of innovation, relatively few of them have the business and administration experience needed to manage and expand technology firms. To help meet this need, UCSD will open a graduate business school in 2004, and has already begun a dual major PhD/MBA programme with San Diego State University. This programme allows molecular-biology students to earn a business degree at the same time as working for their main degree.

Junfu Zhang, a research fellow at the Public Policy Institute of California, says that entrepreneurs who can understand both business and science — such as those graduating from a dual programme — are more likely to succeed than those following a more traditional degree path. Zhang has studied California's high-tech industry and found that 40% of venture-backed entrepreneurs came from a university setting. "You can never over-estimate the role played by universities in developing entrepreneurship," he says.

Saturation point

Nevertheless, industry executives and other experts are warning that San Diego's technology cluster is facing some immediate challenges. At 50% above the national average, house prices are very high compared with wages, commuting times are increasing and the area is running out of land that can be developed. City of San Diego councilor Scott Peters admits that the region could soon become a victim of its own success. "It's getting a little crowded," he says.

This crowding was painfully clear during October, when wildfires spread from house to house, destroying 2,400 homes and killing 16 people in San Diego County. Fortunately for the region's tech development, no research centre was destroyed and most analysts believe that there will not be a long-term economic effect.

Despite the damage caused by the fires in rural San Diego, the most pressing issue is the long-term provision of housing. Currently, only one in five San Diego families can afford the average house price of about $380,000 ($490,000 for new homes). Many young families moving to the area are forced to seek out cheaper housing in areas north and east of the city, such as Riverside county, about 60 minutes away by car. The housing situation is so bad that the city council declared a 'housing emergency' in 2003, and is looking for innovative ways to encourage developers to build more housing that is affordable to low- and middle-income earners.

"It's a market issue," says Peters, "and probably bigger than we can do locally. We do have to find a way to make investment in housing more attractive to private capital." One possibility, Peters says, is to require suburban developers to include in their plots a certain number of housing units that are affordable to low- and middle-income residents, although builders are distinctly uneasy about this proposal.

Another problem is the lack of water in the region. San Diego imports 80% of its water from the Colorado River 200 kilometres to the east. But the federal government has ordered California to reduce its use of the river by 20% over the next decade. San Diego officials are looking at alternatives such as desalination and recycling. Already, firms such as Ligand Pharmaceuticals, a biotech firm based in San Diego, are using reclaimed water in their manufacturing, but the price of water is likely to add to the cost of doing business in San Diego. As a state, California is taking an increased amount of water from agricultural regions to sell to the cities. So far, it is not clear how the cost structure will pan out, although analysts agree that the price of water is going to go up.

The amount of land left to build on is shrinking, and the vaunted Torrey Mesa area is developed almost to capacity. The recent wildfires were a disquieting reminder that the wholesale real estate development in the region makes it especially vulnerable to natural disasters.

As a result, San Diego firms are starting to look for cheaper locations. IDEC Pharmaceuticals recently opened a manufacturing centre 32 kilometres north of San Diego in the city of Carlsbad (but now that it has merged with Biogen, it will move its headquarters to Massachusetts), and CancerVax is relocating its manufacturing to a Los Angeles suburb.

California officials, meanwhile, are mired in a state budget deficit of at least $10 billion, which could double or even triple by the middle of 2004. The state's newly elected governor, Arnold Schwarzenegger, hopes to sell bonds to plug the growing hole in the budget, but the legality of such a move is under question in the courts.

Despite the uncertainties, technology leaders in San Diego say that they are optimistic about the future. Local economic forecasters expect the region's population to grow from 2.8 million in 2000 to 3.6 million in 2020. Industry chiefs note that San Diego has grown steadily in the past 15 years by focusing on education, cross-discipline training and a cooperative business atmosphere. Although they admit that the technology cluster won't continue to grow forever, they believe that they can adapt to economic changes, natural disasters and population growth.

"We've lived with earthquakes and other disasters and people still come to California," says Joseph Panetta, executive director of BIOCOM. "We have to continue to maintain a business climate in San Diego that will allow us to continue to attract people."

Nature 426, 696 - 697 (11 December 2003); doi:10.1038/426696

The view from the top

KEN HOWARD

Ken Howard is a contributing editor for Nature.

San Diego is facing significant challenges to its future development. How do the some of the region's leading lights think it will cope? Ken Howard finds out.

How does the health of the general economy determine the fortunes of the high-tech and biotech sector? What country is the biggest challenge to the United States' dominance in these fields? Where does San Diego fit into the global high-tech enterprise? Nature asks some of San Diego's leading people in business and academia:

|

MARTHA DENNIS: BALDERAS |

|

Left to right: Martha Dennis; David Gollaher; David Hale; Michael Jackson; Tina Nova; Larry Smarr; Marco Thompson |

How connected are the fortunes of high-tech/biotech to those of the general economy?

Martha Dennis: In general, the near-term fortunes of high-tech very closely reflect the economy. A good part of the high-tech market is determined by consumers' disposable income, and the availability of capital for new development is tied to the state of the stock market. One exception is the defence sector, which, of course, also feeds a good portion of the high-tech market, and is somewhat less vulnerable to the ups and downs of the economy.

David Gollaher: The general economy and the capital markets are the basic platform for starting new ventures, so if there's really a bear market or a market like the one we saw in 1993, there is much less risk capital available for new ventures. In a broader sense though, biotech, medical technology and medicine have the wind at their back. We have an ageing population and an increasing ability to mitigate the effects of age through medical technology, so there is an enormous demand for these products. The macroeconomy will certainly affect company formation, but the market, the ultimate demand for these products, is growing.

What is the weakest link in technology transfer out of academia?

Michael Jackson: Typically, when the first gem of an idea doesn't turn out to really go anywhere. After two years the company is no longer working on the kernel of what the founders were working on. The original idea didn't pan out, but they still have money. And they're lost.

Tina Nova: Universities should encourage development of new discoveries on campus to narrow the gap between academic science and marketable product before offering a technology or compound for licensing. Good models for this are PharmaSTART (a consortium of research organizations that offers drug-development services to California-based universities, research institutes and small biotech companies) and the von Liebig Center for Entrepreneurism and Technology Advancement (which promotes the commercialization of the work of the Jacobs School of Engineering) at the University of California, San Diego (UCSD).

Larry Smarr: Universities often have modelled their technology-transfer programmes on owning intellectual property. They should focus instead on how best to move their ideas to market. In this model, the university's financial rewards come from the generosity of successful alumni entrepreneurs instead of revenue streams from intellectual properties. Stanford is the closest university to this ideal.

Martha Dennis: There's lack of recognition that an idea must move from discovery-focused ownership to market-focused ownership. The folk who show genius in one realm are often disasters in the other. There must be a handover from those who invent to those who build the business. The sooner universities recognize this, the faster they'll make money from their intellectual property.

How should the federal government be supporting high-tech/biotech?

Martha Dennis: Government must take on the role of filling the innovation gap that has recently been created by the shutdown or decreased funding of industry-funded research institutions such as Xerox's PARC. In the past these institutions were an essential part of maintaining the research edge that kept the United States ahead of other countries.

Tina Nova: The Small Business Administration should give Small Business Innovation Research grants to venture-backed companies. Currently, many of these grants are in jeopardy, and they can be a lifeline to struggling biotechs.

Marco Thompson: Government should get out of the way. The technology and communications businesses should be deregulated as fast as possible. Government should be supporting basic research with big investments. It should not be helping the telephone service providers now in the market. The consumers should be picking the winners.

Where does San Diego — and the United States — stand in relation to global high-tech/biotech?

David Gollaher: The United States is the global leader by far in biotech, and part of the reason is that it is the only free, non-price-controlled market in the world. Look everywhere, from the United Kingdom to Australia to Germany: all have strong price controls on drugs and medical technology so there's much less incentive in these local markets for company formation. The Europeans are waking up to see how much medical innovation they've lost, and they are very concerned.

On the world stage, you'd have to say that the Bay Area — everything from Silicon Valley up though Berkeley and down to South San Francisco — represents by far the largest cluster. The second would be the Route 128 corridor in Boston and Cambridge in Massachusetts, and the third would be San Diego. What San Diego doesn't have yet is a cluster of large, commercially successful companies that have emerging products on the market. IDEC Pharmaceuticals (developer of therapeutic monoclonal antibodies such as Rituxan) is among the first, but its products are really distributed, and to a large degree manufactured, by Genentech — and, of course, it has now combined with Biogen. So we're still looking for companies that are past the R&D stage to develop commercial manufacturing operations here in San Diego to make it a real powerhouse.

Marco Thompson: Our global leadership is threatened by the quality of our education, and the numbers of engineers graduating elsewhere. Our university infrastructure is the best in the world, and the best foreign students still elect to attend US universities. But our high-school graduates are not even in the top ten in international surveys. Last year, US universities produced 50,000–60,000 engineering graduates. China graduated ten times that. The engineers graduating today are the entrepreneurs of tomorrow.

The main threats to our domination of high-tech come from China and India — I think principally from China. Having a great global competitor in China would be no bad thing for the United States. It will force us to take a long hard look at how we do things, and how we compete.

Martha Dennis: In certain segments of telecommunications in particular, the United States has enjoyed global technical dominance, and the telecommunications innovation companies of San Diego have been a very healthy part of this. Recently, an increased amount of design work is being done abroad. At this point, it is lower-level design work and the intellectual property that San Diego companies are developing is still critical, but there is a concern that this could change.

|

How does San Diego fare for money, status and talent in comparison with other high-tech hubs? Why should I start a high-tech company here?

Marco Thompson: The Bay Area is still far ahead of San Diego in all three. The venture guys are all parked on Sand Hill Road in Palo Alto and most of our entrepreneurs have to get on a one-hour flight every time they raise money. In the Bay Area, they have been at this technology business since Hewlett and Packard set up shop in that famous garage. They have a 20-year start on the rest of the world.

San Diego will establish its status and credentials by building the fastest-growing and healthiest tech community in the world. The secret weapon is the Jacobs School of Engineering at UCSD.

Larry Smarr: San Diego is in a similar position to Silicon Valley in the late 1970s and early 1980s. There is a huge fuel tank to drive this growth in that the San Diego, Irvine and Riverside campuses of the University of California will absorb a large amount of the university's growth over the next decade. For instance, UCSD alone will hire over 400 new faculty. Companies in San Diego are also very collaborative and organized. A good example is the San Diego Telecom Council, which has weekly talks for its nearly 300 member companies.

David Hale: San Diego lab and office space are cheaper than in many East Coast locations, and an influx of pharmaceutical companies such as Pfizer, Merck, Novartis and Johnson & Johnson has deepened the talent pool that all biotech companies draw from.

Martha Dennis: You'll be entering a uniquely open but close-knit technical business community known internationally for mutual support rather than back-biting. And you'll find several world-renowned educational and research institutions. You'll be able to hire staff from a rich pool of technical talent unique to San Diego. And, of course, there's always the climate.

Nature 426, 700 - 704 (11 December 2003); doi:10.1038/426700

Genesis of a high-tech hub

CHLOE VELTMAN

Chloe Veltman is a freelance writer in San Francisco.

A century of philanthropy alongside military research has laid solid foundations for today's diverse sci-tech sector, says Chloe Veltman.

Today, San Diego's North Torrey Pines Road is a congested thoroughfare lined with gleaming high-rises, low-slung modernist office blocks and towering steel cranes. It's difficult to imagine what the epicentre of the city's science and technology community must have looked like before its boom days in the early 1990s.

Inder Verma, a senior scientist at San Diego's prestigious Salk Institute for Biological Studies, has seen the landscape change beyond compare since he arrived more than two decades ago. "That used to be a hill," he says, indicating a local industrial park. "It was all wilderness. My daughter used to roam around here on her horse."

A century of academic and military research is the foundation of the city's present prosperity, both scientific and financial. It began with the first marine research centre, included the foundation of several institutes including the University of California, San Diego (UCSD), and comes up to date with the explosion of high-tech industries in the past few decades. An infrastructure for business has grown to serve sci-tech entrepreneurs, and these days even not-for-profit researchers have to think business if they want to work.

|

S. CHATTOPADHYAY/ BLACKBOOK/AIA/AIA |

|

Grand designs: the Neurosciences Institute (bottom right), and the University of California's Geisel Library (left) and geophysics lab (top right) are examples of San Diego's academic environment. |

The first inklings of what was to become the science and technology hub of Torrey Pines Mesa appeared in 1956, when the city gave defence company General Atomics (GA) 120 hectares of land on which to build a research centre. Keen to increase the high-tech presence in San Diego, city officials later designated the Mesa as a science and technology zone, allowing only high-tech organizations to build there. GA went on to spawn some 60 different science companies, including Sharp Laboratories and Science Applications International Corporation.

Long before GA arrived on the Mesa, San Diego had been priming itself to become a high-tech centre. As early as 1903, when scientist William Ritter founded the Marine Biological Association of San Diego, the city had begun to attract a research community. With funding from a newspaper mogul, E. W. Scripps, Ritter's fledgling marine laboratory transformed itself in 1912 into the Scripps Institution of Oceanography, becoming part of the University of California.

But San Diego's transformation from a town so remote that it was initially bypassed by the railroad to one of the most networked places on Earth can be traced back to the militarization of its economy during the First World War. Hoping that a military presence would strengthen the economy, local government paid for the dredging of the harbour to accommodate navy ships. "As early as 1907, people saw an opportunity for economic growth tied to new technologies and emerging industries," says Mary Walshok, associate vice-chancellor for extended studies and public programmes at UCSD. With its non-stop sunshine and calm waters, the city soon became a favourite repository for federal defence dollars. Military facilities proliferated, bringing in a high concentration of new technologies, from long-distance radio transmission to amphibious warfare.

|

The military presence in San Diego proved a mixed blessing. Although healthy defence income helped lessen the blow of the Depression years and subsequent bust cycles for San Diego, and although the navy built the city's first sewage-treatment facility in 1943 and erected an aqueduct to ameliorate the area's severe water shortage, the price for the people of San Diego was high: by the Second World War, according to Mike Davis, a historian at the University of California, Irvine, San Diego had sacrificed more than a quarter of its land area to the military.

If the time was ripe for the city's science to diversify, it did not have long to wait. After the war, flush with defence dollars, Scripps Institution director Roger Revelle and GA founder John Jay Hopkins wanted to establish a world-class science and engineering graduate school in the area. Revelle even offered a handful of favoured scientists, later to become UCSD's founding faculty, laboratory space at Scripps.

Teething troubles

To launch UCSD, Revelle and Hopkins had to fight a protracted battle on two fronts: with the statewide academic senate that favoured the University of California's campuses at Los Angeles and Berkeley, and with city officials who felt that UCSD should include a full undergraduate programme. UCSD finally opened in 1960 with a postgraduate science focus to support the region's new research economy. "By the time UCSD admitted undergraduates in 1964, it already had a research budget that exceeded that of a typical 100-year-old institution," says Walshok.

By then, the city's civilian scientific community had grown still larger and more diverse (see timeline). The Scripps Clinic and Research Foundation had been founded in 1955, followed a few years later by biosciences centre the Salk Institute. Already an international hero for his Nobel prizewinning work on the polio vaccine, in 1958 Jonas Salk conceived the idea of founding an institute for sciences and humanities, a world-class research organization that would attract the top thinkers across a range of disciplines. On the lookout for a suitable site, Salk visited San Diego in 1959, and decided to build his institute there the following year. The city voted in a special referendum to donate an 11-hectare site around the corner from the Scripps Research Institute for the project, and the National Foundation for Infantile Paralysis, which had funded Salk's polio work, pledged money.

By 1963, the first labs were set up in temporary annexes (which house faculty members to this day; see 'A modernist monastery') and the first generation of resident fellows moved in with Salk, including molecular-biology pioneers Renato Dulbecco, Francis Crick, Salvador Luria and Jacques Monod. Once this illustrious group had taken up residence on the Mesa, the future of San Diego as a scientific juggernaut was sealed.

Other key research centres followed, such as the Burnham Institute (originally called the La Jolla Cancer Research Foundation), and San Diego began to attract significant intellectual capital and funding. But it wasn't until 1968 that San Diego made the crucial connection between academia and commerce. That was when Irwin Jacobs, UCSD professor of computer science and engineering, founded Linkabit, a company that developed military signal-processing equipment and spawned Qualcomm and Leap Wireless — both still have headquarters in San Diego.

Since then, the city's academics have regularly founded companies or served as advisers to them. In 1978, for instance, Ivor Royston and Howard Birndorf, both UCSD scientists, founded Hybritech, the first company to commercialize the use of monoclonal antibody diagnostics. "In 1978, I succeeded in making antibodies for leukaemia, but the only way to get this to patients was to move into mass production," says Royston, who now runs local venture-capital firm Forward Ventures.

An ill-fated merger with pharmaceutical giant Eli Lilly in 1986 ultimately resulted in the sale of the then-moribund Hybritech to the medical-instruments company Beckman Coulter at a fraction of its buying price. Many of Hybritech's leading scientists left to form their own companies, such as IDEC Pharmaceuticals and Amylin: "Ultimately, what was bad for Hybritech was good for San Diego's biotech growth as a whole," says Royston.

|

|

|

Support structure: BIOCOM provides information to San Diego's life-sciences sector. |

But it was still some time before San Diego could capitalize fully on its research successes. "Business services were mismatched, focusing on defence rather than innovation," says Tony Nash, research director at New Economy Strategies, a technology-research firm in Washington DC. "San Diego lacked the intellectual-property attorneys, experienced management, and sources of capital necessary for a burgeoning economy." But with the arrival in 1985 of UCSD CONNECT, a university-based organization that helps researchers develop companies, the science community's commercial engine was shifted up a gear.

The strong relationship between business and academia sparked capital investment, and with it grew a corps of support industries around the Torrey Pines Mesa: from real-estate brokers, specialist law firms and architects to organizations such as BIOCOM, an Internet information service for the San Diego life-sciences industry. "Companies want to be here because we have the support infrastructure here," says Brent Jacobs, senior vice-president of the life-sciences group at real-estate broker Burnham Real Estate. "They no longer have to import builders, architects and other services."

The extra momentum was soon needed. The city's dependence on the military weakened it in the early 1990s when defence cuts led to a loss of 58,000 jobs in the region, says Julie Meier Wright, president and chief executive of the San Diego Regional Economic Development Corporation. By July 1993, unemployment had risen to 8.4%, whereas the national average had declined to 6.9%, according to a survey by Red Herring Research.

|

|

|

San Diego rising. a, Site of Scripps Institution of Oceanography, 1912 (Scripps Instit. Oceanogr.). b, Navy acquires site for Camp Pendleton Marine base (San Diego Hist. Soc.). c, Nuclear subcritical time-of-flight research facility at General Atomics. (CORBIS). d, UCSD's first graduate (UCSD). e, The Burnham Institute today (Burnham Inst.). f, Genetic engineer's vanity number plate (T. Spiegel/CORBIS). g, Sidney Karin, founder of UCSD's Supercomputer Center with the centre's first Cray computer (San Diego Supercomput. Center). h, Microcirculation lab at UCSD's Dept of Bioengineering (UCSD). |

Variety show

Fortunately for San Diego, the fact that companies as varied as Qualcomm, General Instruments and Stratagene have made a comfortable base for themselves in San Diego owes as much to the region's roots in academic research as to its military history. The combination of decades of research and a strong entrepreneurial spirit launched the biotech, telecoms and information-technology companies that would help the region bounce back. "Since the early 1990s, our economy has diversified with industries such as wireless communications and life sciences reaching critical mass," says Wright. Through numerous boom-and-bust cycles, diversification has been key to San Diego's recovery and comparative immunity to economic downturns.

|

In recent years, the rate of change on the Mesa has accelerated. Drawn by the promise of breakthrough drugs and the collegial atmosphere, global pharmaceutical companies have arrived in droves. Pfizer, for example, has set up a 70,000-square-metre research facility. Others, meanwhile, have forged partnerships with smaller biotech firms as happened in Eli Lilly's collaboration with Structural GenomiX. Novartis has an agreement with Scripps in which the company pays the institute $20 million a year for first rights to choose up to 47% of ideas for product development until 2006. Over the past five years, major drug companies have committed more than $1.5 billion in research and development alliances with San Diego biotech firms, according to a report from the Brookings Institution.

And a new wave of military research has come with a surge in 'biodefence' companies. Defence research has won one of the biggest increases in the 2003 federal R&D budget, accounting for nearly 55% of US research spending, up from about 52% in 2002. There are now around 75 dedicated biodefence firms in San Diego, and other biotech companies are exploring ways to catch extra defence dollars. The biotech firm Chimerix, for example, was recently awarded a $36-million grant from the National Institutes of Health (NIH) to develop a therapy for smallpox, classified as a 'category A' bioterrorism threat by the federal government.

But general investment in the science and technology industry and academic research is down. According to Red Herring Research, venture-capital investment decreased by more than 30% between 2000 and 2001. "We can't fund science for its own sake," says Royston. "A few years ago, early-stage research could be funded, but financing is generally only available today for companies on their way to developing products."

The changing investment scene, and the huge California state budget deficit of at least $10 billion, is also weighing heavily on academic organizations. "The depression within the industry has transferred the burden of translational research to academic institutions," says Ronald Evans, a long-serving scientist at the Salk Institute. "But our forte isn't commercialization, it's discovery."

With some of San Diego's academic institutions struggling to fulfill their basic research mandate in these tougher times, many researchers have begun to look for ways to bridge the funding gap. Ken Chien, director of UCSD's Institute of Molecular Medicine, believes that there will be an increasing focus on translational research — working at the interface between pure biology and its application in clinical treatments. Chien envisions increasing the number and output of physician–scientist training programmes, developing private-sector partnerships and establishing interdisciplinary teams with a range of academic and commercial skills.

San Diego's high-tech specialism has grown over many years from a unique confluence of geography, military spending, world-class academic centres and the connections fostered between the local business and research communities. "It's taken decades for San Diego to reap the benefits," says Nash. "Other regions are trying to take short-cuts but it's hard to develop excellence quickly."

San Diego faces further challenges in the coming years: increasing congestion, inadequate infrastructure — such as a lack of affordable housing — and only one small airport (see 'Good neighbours', page 690). But despite growing pains, its reputation as a high-tech haven remains high (see 'Sun, surf...and cultural evolution'). "Everybody wants to come here," says Evans, strolling across the Salk Institute's exquisitely designed plaza towards his cosy, naturally lit office. Its previous tenant was Jonas Salk himself. "I've been here for 25 years and I don't feel much of a push to leave."

Nature 426, 706 - 707 (11 December 2003); doi:10.1038/426706

Best of both worlds

PAUL SMAGLIK

Paul Smaglik is editor of Naturejobs.

What makes the Mesa so attractive to pharmaceutical companies? Paul Smaglik investigates.

|

R. DOYLE/CORBIS |

|

Dual purpose: San Diego's Mesa has proved appealing to both biotech and pharmaceutical companies. |

The density of life-science companies and institutions in San Diego was one of the main attractions for Polly Murphy when she was looking for a new post. "If one job doesn't work out, there's a hundred right down the road," Murphy says. She also had to consider whether her husband, a psychologist, could find work in the area. But they both soon secured employment and made the move from the east coast.

Within a year, her new employer Aurora Biosciences was acquired by Vertex Pharmaceuticals in Cambridge, Massachusetts. Worried that her job might shift back to the east coast, Murphy began to look for a local alternative. True to her theory, she found a job down the road at the Salk Institute for Biological Sciences as vice-president of technology management.

|

|

|

Rising tide: employment in San Diego's biotech and pharmaceutical sector. |

In fact, Murphy could have chosen from a range of opportunities in pharmaceutical or biotechnology companies. Employment in these sectors has more than doubled between 1990 and 2000 in the San Diego area (see graph). Even in the past three years, as other US cities have shed jobs, San Diego has continued to gain them, albeit at a slower rate than during the previous decade, says Marney Cox, chief economist with regional planning agency the San Diego Association of Governments.

There are now about 400 life-science companies in the San Diego area. And even though about 90% of these firms have fewer than 100 employees, the potential for growth is already present. Many have products in phase III clinical trials, the last stage before a drug is approved to go to market. And some firms are strengthening their ties with the area's defence industry. This could lead to an increase in biodefence funds — especially as San Diego has a good reputation for immunological research (particularly for vaccines and the detection of dangerous biological organisms such as anthrax).

But in the past decade, San Diego has also become home to some of the big names in the drug industry. Johnson & Johnson was the first big pharmaceutical firm to take an interest in the area. In the early 1980s, the company began funding research at the Scripps Research Institute on the understanding that it would have the right of first refusal if it wanted to commercialize any of the institute's discoveries. In 1994, the company recruited Per Peterson, then head of the immunology department at Scripps, to become chairman of research and development. He recruited six other scientists from Scripps in order to establish a core team in immunology.

Collaborative efforts

Johnson & Johnson's deal with Scripps ended in 1996, after which Novartis secured the offer of first refusal. Despite this, Johnson & Johnson's research in San Diego has grown from the initial seven scientists in 1994 to over 250 employees now. Its research areas include neuroscience, pain, infectious diseases and physiological systems. All teams are multidisciplinary and have biology and chemistry components.

What hasn't changed with the expansion is the close cooperation with the academic community that brought Johnson & Johnson there in the first place, says Tim Lovenberg, biology discovery team leader at the company, who describes the Torrey Pines Mesa as one giant 'open campus'.

Access to that campus for pharmaceutical companies became more important when Richard Lerner, president of Scripps, decided to change what was a "desert" for organic chemists into an oasis for them, says Mike Varney, vice-president of drug discovery at Pfizer in La Jolla. In the early 1990s, Scripps started to build up its organic-chemistry capabilities and the University of California, San Diego, soon followed suit.

This rising strength proved attractive to Pfizer's chief executive, Hank McKinnell, when he visited the region in 2000 to see Agouron, one of the company's recent acquisitions. McKinnell was impressed with the concentration of expertise on the Mesa. So he decided to buy some land there to enhance links between Agouron's structural approach to drug design and the chemical expertise already in the area.

Agouron is now based at Pfizer's newly built San Diego facility, which is home to some 1,300 researchers. Pfizer plans to expand this workforce to about 1,500, and aims to focus on structure-based drug design at the centre using Agouron's expertise in cancer, viral diseases, diabetes and diseases of the eye.

In addition, Pfizer hopes to benefit from the surrounding academic community, which plays a supporting role in the company's research direction. Varney says that there are both "directed" and "random" components to the reasons why Pfizer and other companies pursue particular research directions in the area. For example, Jerry Olefsky, a professor of medicine at the University of California, San Diego, conducted some preclinical studies for Pfizer's diabetes therapies. "This was a contributing factor to setting up diabetes and obesity as a therapeutic area at Pfizer's La Jolla site three years ago, and a useful consulting relationship now exists between the company and Olefsky," says Varney.

Pfizer and Johnson & Johnson are not alone in having close links with the academic community. In 1999, the Novartis Research Foundation established its Genomics Institute (GNF) in an effort to bring together life sciences, chemistry, informatics and engineering. Employing about 450 people, the GNF splits its work equally between technology, basic biomedical research and drug discovery.

"The institute is a hybrid of academic and biotech research," says Peter Schultz, the GNF's director. This is a combination that Schultz believes gives the GNF a significant advantage. On the one hand it has technology and infrastructure not usually found at universities, on the other it has an open publication policy and can take a more opportunistic approach to research than would normally be possible at a conventional for-profit company, he says.

The GNF's hybrid nature has also allowed it to foster collaborations beyond scientists at Novartis, says Christina Waters, the institute's director of scientific development. "We can conduct independent research with other academic groups, biotech firms, and private institutions," she explains. In particular it has a strong relationship with Scripps, which is located across the road from the GNF — some GNF scientists, including Schultz, have joint faculty appointments with Scripps.

Strong connections

In fact, many companies in the region have links with academia. For example, Elan Pharmaceuticals hosts the San Diego Biotechnology Discussion Group at its Sorrento Valley location. Nabil Hanna, executive vice-president of research for Biogen Idec, says that gatherings such as the discussion group and seminars held at the academic institutions on the Mesa make recruitment easier.

But that also means opening oneself up to competition for recruits. "We hired some people from Amgen and lost some other people to Amgen," says Hanna. That sort of circulation is healthy as it allows companies to get experienced employees in management, development and regulatory affairs — experience that can't be acquired by recruiting out of universities, Hanna says.

When Stanley Crooke was looking to set up ISIS Pharmaceuticals, a company to focus on antisense therapy, he investigated several locations. Now chairman and chief executive of the company, he travelled to San Diego, liked the weather and scenery and decided to locate ISIS in Sorrento Valley, just north of La Jolla, says Shannon Devers, associate director of human resources for the firm. The ability to attract scientists from nearby academic research institutions was a bonus, she adds.

Schering-Plough also has a small presence in San Diego through Canji, a wholly owned subsidiary. Canji has 58 employees, almost all researchers. The biotechnology company focuses on gene therapy for cancer.

But not all drug companies with a presence in San Diego are expanding. Merck, which established itself in the area when it bought SIBIA Neurosciences in August 1999, peaked at 180 employees. But as part of a companywide cutback of 4,400 employees, it is reducing that number to about 100. And last year, agribusiness giant Syngenta announced that it was closing its Torrey Mesa Research Institute in San Diego, shedding about 80 jobs, including scientists and support staff (see Nature 420, 598–599; 2002).

But for every closure, there seems to be new investment. Last month, Indianapolis-based Eli Lilly announced that it would acquire Applied Molecular Evolution, a San Diego proteomics company. And earlier this year, two San Diego firms received investment from drug companies when venture capital was tight. Amylin Pharmaceuticals reached a $400-million deal with Eli Lilly in September to market a diabetes drug currently completing the last stage of clinical trials. And Neurocrine Biosciences struck a similar deal with Pfizer last December to market the biotech firm's insomnia drug.

Murphy, meanwhile, notes that, despite all the mergers and movements of corporate headquarters from one coast to the other, she still sees a net gain for San Diego. Although she was disappointed to learn that IDEC Pharmaceuticals' corporate headquarters would shift to Massachusetts following the recent merger with Biogen, the growth of Pfizer and GNF more than make up for it.

The result of all this activity is a large variety of companies and academic institutions in a relatively contained area. That has meant more opportunities, not just for researchers but also for people providing ancillary services, such as marketing, public relations and law. Ten years ago, there were few companies specializing in these services for the life sciences. Now there are about 100.

"If you're someone with skills and you want to work in San Diego, you can do it," Murphy says.

Nature 426, 708 (11 December 2003); doi:10.1038/426708

Turning technology into gold

JONATHAN KNIGHT

Jonathan Knight is a contributing correspondent for Nature.

Scientists need help to make their entrepreneurial dreams come true. Jonathan Knight talks to the experts.

There are probably few scientists who have never had an entrepreneurial thought. Many researchers, at least fleetingly, have considered what it would be like to stumble across something with a real-world application and to see it move to a commercial setting.

In San Diego, as in other technology centres, discoveries flow from the laboratory bench to the marketplace with the help of specialists in technology transfer. "We are like venture capitalists, only we deal in patents," explains Alan Paau, who heads the technology-transfer office at the University of California, San Diego (UCSD).

Through licensing and other intellectual-property deals, Paau's office has created 120 start-up companies in San Diego in the past decade. These firms, combined with numerous ventures started by the other major research centres in the region, have helped to transform the town into today's high-tech hub, Paau says.

So how does technology transfer help San Diego? After all, just because a technology is invented in San Diego, it doesn't mean that it will be licensed to a San Diego firm. The top bidder for the invention could just as easily be based in Boston or Hong Kong.

Several factors keep the technology local. One is that the inventor is more readily available for consultation if companies are located close the technology's birthplace. Another is the practice at UCSD of giving preference to local companies, even if this means forgoing a higher bid for a license. "As a state-run institution, we have a responsibility to focus locally," says Paau. There are also a number of organizations, such as UCSD CONNECT, keen to help start-up firms find their feet.

Before the licensing stage, someone has to decide whether the invention is worth patenting. This is where technology-transfer offices come in. Sangeeta Bhatia, a tissue engineer at UCSD who has invented a number of patented technologies, says these offices are indispensable. "Without their services, most of our biomedical innovations would be worthless," she says.

Many discoveries do not have market potential, although a researcher may find this difficult to accept. "Faculty members are in no position to judge the commercial viability of their invention," says Arnold LaGuardia, executive vice-president of the Scripps Research Institute. It is up to the licensing officer at the tech-transfer office to take a sober look at the invention and make the call.

|

Some research centres, such as the Salk Institute for Biological Studies, require their faculty members to report inventions to the technology-transfer office. The Scripps Research Institute goes further, reviewing every manuscript for potentially patentable discoveries before it is submitted to a journal.

More often than not, the answer from the licensing officer is no. In the fiscal year ending June 2002, the latest period for which figures are available, 255 inventions were reported to the technology-transfer office at UCSD, but only 112 patent applications were filed. One of the reasons for deciding not to patent is that a similar patent already exists. More frequently, however, it is because the licensing officer does not see any viable market for the technology.

One approach to applying for a patent is to find a company that is willing to pay the cost of filing, which usually adds up to $25,000 for a US patent and up to ten times as much for a foreign patent. In exchange, the company gets an option to license the technology. In this model, the institution's costs are covered, and there is no reason not to patent even if a real market never materializes.

Basic research seldom leads to inventions that are obvious money-makers. Yet many early-stage innovations hold a great deal of promise for the future. "The things that will be big in the next few years were patented ten years ago," says Polly Murphy, head of technology management at the Salk Institute.

|

|

So everyone must do a certain amount of 'at-risk' filing, which means applying for a patent without a licensor. Murphy estimates that about 40% of Salk's existing patents and patent applications are done this way, a fairly typical percentage for research institutions. John Campbell, director of intellectual property at the Burnham Institute in La Jolla agrees. "We are willing to file a patent application and then wait until the market catches up," he says.

Usually, the patents that pay off make up for those that never find a market. For example, the Salk's patent on a research tool for inserting foreign genes into experimental organisms, filed in the mid-1990s before there was any commercial interest, has become a major revenue generator, although the institute would not say the actual amount.

Without good technology transfer, San Diego might never have seen a tech boom. As it turned out, for the scientist with an entrepreneurial bent, it's home-sweet-home.

Nature 426, 709 - 711 (11 December 2003); doi:10.1038/426709

Tomorrow's world

JONATHAN KNIGHT

Jonathan Knight is a contributing correspondent for Nature.

Jonathan Knight takes a look at what the future may hold for innovation in San Diego.

Predicting the future is a notoriously precarious occupation. But San Diego, with its wealth of biotech and high-tech expertise, offers a ready guide to likely successes. True, there are a lot of projects that sit firmly in the speculative category, but there are also emerging technologies that are already making their influence felt. Drawing up a comprehensive list of such developments is impossible, but from the marriage of microfabrication with cell biology to a mixture of wireless communication and medical health, a feel for the region's innovation is easy to obtain. Here, in no particular order, we present five of the hot prospects that are helping San Diego to assert itself on the global stage.

Chemical sensors

What's that smell? Is it toxic discharge from the factory up the river? Is it nerve gas from a terrorist attack? Or is it just an open rubbish bin? Increasingly, people — particularly military personnel and emergency response teams — would like to know what is in the air.

Seacoast Science based in Carlsbad is one of a handful of companies nationwide working on the next generation of accurate, lightweight chemical sensors. It has a prototype that it hopes will end up clipped to the shirts of US Army soldiers in two years' time.

|

|

|

Small and sensitive: Seacoast's chemical sensors can distinguish between several gases. |

The portability of the chemical detectors currently used by the US military is hampered by the fact that they are powered by batteries weighing several kilograms. In addition, the sensors are not particularly discerning. An alarm could mean a nerve-gas attack or that farmers down the road are spraying pesticides on their fields.

Part of a solution to the portability problem is to use microelectromechanical systems: fingernail-sized devices that require only 5 microwatts for one chip of ten capacitors. Seacoast's design packs ten sensors onto a chip just 2 mm by 5 mm. Each sensor is 360 micrometres in diameter and consists of a thin layer of specialized polymer sandwiched between two conductive discs. The chemical of interest enters the sensor through perforations in the top disc and is absorbed by the polymer, altering the electrical capacitance of the polymer sandwich. This change is detected electronically.

The polymer layer is the key to this technology. Todd Mlsna, Seacoast's co-founder and president, has developed a series of absorbent polymers, each sensitive to a different class of chemical. Each of the ten sensors on a chip contains a different polymer, and any given gas changes the capacitance of the polymer sandwich at a different rate. This produces a unique electronic signature for the gas, and enables the chip to distinguish far more than ten compounds. By varying the polymers, Seacoast can tailor a chip to a given class of chemical.

In October, the company tested its sensor at the US Army Medical Research Institute of Chemical Defense in Aberdeen Proving Ground, Maryland, and showed that it could detect minute concentrations of nerve gas. Seacoast has already produced six prototypes for the Marines and is now developing ones with sensitivity to toxic industrial chemicals.

The advantage of Seacoast's sensors is their portability — every soldier can carry one. The chips do not yet distinguish nerve agents from chemically related pesticides, but this may be possible as more sensors are developed or a chemical-separation step added, according to Mlsna. "We like to think we are developing the heart of all future sensor systems," he says.

Artificial livers

Could making artificial organs one day be as simple as assembling computer chips? Sangeeta Bhatia, a bioengineer at the University of California, San Diego, thinks so. She is borrowing tools from the semiconductor industry to build artificial livers. So far, she has made only tiny liver fragments, but she hopes one day to build an entire lobe of liver suitable for transplanting into a patient.

Transplants are currently the only cure for patients with severe liver damage. But there aren't enough livers being donated. In the United States alone, 18,000 patients are waiting for a liver transplant, according to the American Liver Foundation, outstripping supply by fourfold.

External artificial livers, which are similar to kidney dialysis machines except that they use living cells, would extend the lives of patients waiting for a donor, but previous attempts to develop these have failed in clinical trials. One reason for this, Bhatia says, is that the liver cells tend to lose their ability to detoxify blood. To solve this problem, she grows the liver cells next to the support cells that surround them in the real organ and provide essential growth factors. She uses microfabrication tools developed for making microchips in Silicon Valley to lay down the cells in specific patterns and so control how much they interact with one another. This produces an artificial liver that is ten times more effective compared with one based on liver cells alone, she says.

|

But to make an entire liver suitable for transplantation, it is necessary to move away from two-dimensional cell cultures because livers are three-dimensional, not merely a layer of cells. Bhatia has begun making three-dimensional liver sections using another microfabrication method called stereolithography. This techniques uses a liquid resin that is solidified layer by layer by a laser beam. For example, to make an object shaped like a tumbler, the beam sweeps back and forth across a shallow dish of resin until it forms a solid disk, which will be the bottom of the tumbler. The disk is submerged slightly deeper in the resin so that the next layer can be solidified. The laser beam must hit the liquid resin — if the disk is floating the beam will only hit the already hardened disk. Further successive rings make up the sides of tumbler. This technique can be used to make almost any three-dimensional structure.

Bhatia has developed a resin that will support growing cells (V. A. Liu and S. N. Bhatia Biomed. Microdev. 4, 257–266; 2002). She mixes in liver cells, and then builds up successive layers of cells into a cube with sides of 1 mm. She leaves holes in each layer so that this small section of artificial liver has a branching vasculature like that found in real liver tissue. Bhatia uses stereolithography to make tiny liver chunks, in which the cells survive and are supported by the matrix. Work is under way to test their function.

The first application for these artificial livers could be in testing new drugs. Some 25% of new drugs fail clinical trials on people because the liver inactivates them too quickly. If this could be anticipated, the pharmaceutical industry could save a great deal of money.

Making a functional liver for transplant is still far in the future, Bhatia says. At the moment she is using just one type of support cell, but at least three of the five major cell types found in the liver would be needed for a functional organ. This requires a much deeper understanding of how the cells interact.

Medicine patches

Only about half the patients receiving prescription medications for a chronic illness actually take them. For people with a serious condition, such as diabetes or congestive heart failure, non-compliance can mean a trip to the hospital, or worse.

Wearable devices that automatically dispense medications have been sought after for years, but very few are actually on the market. Insulin pumps for diabetics that look like pagers and are worn on a belt are available, but they don't automatically measure blood glucose levels or communicate with the physician who is managing the disease.

|

V. A. LIU AND S. N. BHATIA, BIOMED. MICRODEV. 4, 257–266; 2002/KLUWER |

|

Control and construction: PhiloMetron's smart medicine patch monitors the heart and sends this information to the doctor, who can then decide how much medication to dispense (left). A three-dimensional liver-like tissue structure made from three layers of liver cells. Each layer of cells is fluorescently labeled with a different colour dye (right). |

PhiloMetron, a start-up company in Sorrento Valley, is now taking the first steps towards tele-electronic medicine dispensers by developing what is essentially a smart skin patch that phones your doctor. The patch, which measures about 5 cm in diameter, monitors the electrical activity of the heart and sends the data at regular intervals to a nearby mobile phone, which in turn calls the doctor's office; the two steps avoid the need for a bulky transmitter in the patch itself. A clinician looks at the readings, decides how much drug to dispense, and transmits the instructions back to the skin patch, which then delivers the drug. All the patient has to do is change the patch once a week.

PhiloMetron's initial design takes advantage of an existing technology, an implanted cardio defibrillator (ICD), to gather the heart data. This is a sort of super-pacemaker that shocks the heart into a regular rhythm in the event of a heart attack. The patch can potentially go one step further too. By linking to the data provided by the ICD, it could reduce the chance of a heart attack by dispensing drugs at the appropriate time.

The next generation of patches are likely to house the data-gathering information too, so that they will work for patients who don't have an ICD fitted.

For the moment, PhiloMetron, with fewer than ten employees, remains entirely focused on the cardiac application, says president and chief executive Darrel Drinan. But it is not hard to imagine tele-medicine applications for a variety of diseases. Sensors that transmit data to the clinic from wherever the patient is would not only cut down on visits to the doctor and the hospital, they would allow physicians to spot problems before they became severe.

During the severe acute respiratory syndrome (SARS) epidemic, in which the first sign of infection was fever, Drinan says he had a number of e-mails from Hong Kong asking if he had anything that could remotely monitor body temperature. "The interest in this concept is extremely high," he says.

Free-space optics

San Diego is most closely associated with one technology: wireless communication. Wireless transmission usually involves radiowaves or microwaves, but several companies in the San Diego region are developing technology based on something a little more tangible — light.

Fibre-optic cables already use light to transfer huge amounts of data. Thousands of miles of cable have been laid in the past decade, yet relatively few businesses or consumers have fibre-optic links to their desktop computers or between their private networks. This is because of the 'last mile' problem: bringing fibre-optic cables into existing buildings and houses means digging up streets and car parks. As long as existing copper wire — telephone lines and television cables — provide a reasonably fast service, the incentive to replace this technology isn't there.

Lightpointe is one of four major companies — all of which are based on the US west coast — that aim to overcome this issue by ditching the cable altogether. Free-space optics (FSO) is, in effect, fibre optics without the glass. Air is a perfectly good transmission medium for light, so sending a high-bandwidth data stream from one building to the next could be as simple as mounting a laser on one rooftop and pointing it at a receiver on another. Already there are some 10,000 FSO units installed worldwide.

Surprisingly, rain and snow do not affect the light signal. This is because Lightpointe units use four parallel laser beams to help keep the signal continuous. And lost data packets are sent again, as they usually are on the Internet. "It has to be complete white-out conditions to stop these," says Jeff Bean, spokesman for Lightpointe.

But FSO technology does have an Achilles' heel: fog. The average size of fog droplets is one micrometre, the same as the wavelength used by standard data transmission lasers. Even a light fog can shut down FSO.

Maxima, a company based in Sorrento Valley, is trying to solve this problem by using longer wavelengths of light. Its research suggests that a wavelength of 10 micrometres would be transmitted through fog, but lasers for this wavelength are not widely available. So Maxima has joined forces with the small Swiss company Alpes Lasers, based in Neuchâtel, which has developed a laser smaller than the head of a pin that transmits a 10-micrometre beam with sufficient strength to be read hundreds of metres away. Another company, Vigo Systems in Warsaw, Poland, has designed an appropriate detector, and Maxima plans to try the new units out on customers' rooftops by the end of 2004.

|

S. P. KANE |

|

Light work: This unit from Maxima transmits light through air, avoiding the need for wires or cables (top). Computer models from Genomatica help biologists cope with vast amounts of genomic and biochemical data (bottom). |

The longer wavelength has other advantages, says president and founder of Maxima James Plante. It is so far in the infrared, that sunlight has very little effect on it, so there is no interference when the Sun sets behind a data link.

In silico biology

The sequencing of a range of genomes in recent years has left many biologists with a problem. How can they make sense of so much data, particularly when the information relates to thousands of proteins involved in a slew of interdependent biochemical pathways.

Bioinformatics is helping biologists to cope with the reams of data they face every day. But few efforts are aimed at bringing all the data together into a single model to form a digital organism with the power of prediction.

Bernard Palsson, a bioengineer at the University of California, San Diego, has designed computer models of bacteria that incorporate the constraints of all their known metabolic pathways. In a paper in Nature last year, he and his team showed that their approach could accurately predict how a strain of the bacterium Escherichia coli would adapt to a new source of food (R. U. Ibarra, J. S. Edwards and B. O. Palsson Nature 420, 186–189; 2002).

The San Diego company Genomatica, co-founded by Palsson and his former student Christophe Schilling, is now making its computerized bacteria available to researchers worldwide. The model, dubbed SimPheny, incorporates everything known about an organism's physiology, from how it metabolizes food to how it divides.

And the models aren't limited to one type of bacterium. Derek Lovley, a microbiologist at the University of Massachusetts in Amherst who works on the bacterium Geobacter, is a complete convert. In one case, SimPheny helped Lovley to work out which gene was mutated in a strain of Geobacter that was growing poorly in culture. In another, it predicted that a particular mutation would produce a strange metabolic effect that Lovley would not have tested for had the program not come up with it, he says.

Nature 426, 712 (11 December 2003); doi:10.1038/426712

Different directions?

LISA BOWMAN

Lisa Bowman is a freelance writer based in San Francisco.

How independent are the boards of San Diego's high-tech companies? Lisa Bowman investigates the multiple directors.

|

MILES COLE |

The wave of corporate scandals that dragged down Enron also rolled over the US technology and science companies WorldCom and ImClone. Now savvy investors, corporate governance experts and potential customers are taking a close interest in who sits on a company's board of directors. Are board members independent, or do they have ties to company insiders or positions on other boards?

In the San Diego region, the board of Qualcomm, which makes wireless network equipment and is one of the region's largest tech companies, has at least four members who perform the same role elsewhere. For instance, Ray Dittamore is a director not only of Qualcomm but of the science companies Invitrogen, Gen-Probe and Applied Molecular Evolution. Other technology and science companies in the region with board-hopping directors include Anacomp, SYS Technologies and Science Applications International Corporation (SAIC).

It is hard to quantify exactly what difference directors can make to research and development work in a company. A board is supposed to monitor a company, not meddle in its everyday affairs — but directors can wield significant indirect influence. Although they do not dictate what research is done, they do work with management to set strategies and allocate resources, actions that may result in one project being killed and another spawned.

Like many corporate governance experts, Charles Elson of the University of Delaware in Newark sees no benefit to multiple directorships. "The more boards you're on, the less effective a monitor you become," he says. "It's a job that takes a lot of time." Many also question whether multiple directors are likely to challenge management decisions. "Are they getting appointed because they're diligent monitors or because they're not boat-rockers?" asks Benjamin Hermalin, a professor of banking and finance at the University of California, Berkeley.

And what do the directors get out of it? Some are corporate go-getters who enjoy helping young companies along. Others are eager for the cachet and power that accompanies a directorship. Then there's the pay: in 2002 an average board member who was not also employed by the company received about $122,000 for the year in cash payments (retainers and per-meeting fees) and equities (grants of stock, stock options and restricted shares) according to a study of 250 companies from the Standard & Poor's 500 index, conducted by human resource consultants Towers Perrin.

|

But there can be some advantages to the practice too. Hermalin says that multiple directorships, although generally not recommended, could lead to collaboration between companies in the quickly changing fields of technology and science. Someone who is familiar with the industry landscape may spot opportunities or partnerships that another would overlook.

Or a director may have other valuable experience, says Larry Stambaugh, chief executive of San Diego-based Maxim Pharmaceuticals and a board member of the Corporate Directors Forum. The forum frowns upon multiple directorships, but Stambaugh says that they may make sense in certain cases, especially if a director is an expert in accounting and oversight. For example, he points out, Dittamore retired after 35 years as a managing partner at accounting firm Ernst & Young, making him a natural target for companies seeking auditing expertise on their boards.

What's more, says Stambaugh, biotechnology start-ups — of which San Diego is a hotbed — often seek out pharmaceutical executives for their boards. "They have good access to how pharmaceutical companies are thinking, what contacts might be out there, and insight into the commercial drug process," he says. "That knowledge is helpful to a young company."

But the general trend in the United States seems to be against multiple directorships. According to the June issue of business magazine Forbes, the number of people serving on five or more boards at major US companies has declined from 18 to 9 in the past year. Many companies are also starting to limit the number of other boards their directors can sit on.

San Diego companies get particularly high marks for corporate governance. For example, 30 of the top 45 public companies in San Diego have better than average corporate governance practices, according to ratings by Institutional Shareholder Services, which examines corporate leadership for institutional investors.

Stambaugh says that directors are taking their jobs more seriously and putting in much longer hours than they did in years past. "What really changes corporate governance policies is not legislation, it's attitude, energy, putting in time and knowing how to do a good job," he emphasizes.

Nature 426, 713 - 717 (11 December 2003); doi:10.1038/426713

In search of the élite

VIRGINIA GEWIN

Virginia Gewin is a freelance writer based in Corvallis, Oregon.

A huge number of people have contributed to the success of San Diego. Virginia Gewin catches up with a selection of the region's prime movers.

The rise of San Diego has been remarkable. In just 30 years, it has secured itself a prime position in the world of biotech and high-tech innovation. But who helped to shape this vision? Who ensured that the region did not buckle under the pressures of recession?

There are many names on this roll of honour — those who facilitated San Diego's rejuvenation, those whose entrepreneurial vision has laid the foundations for the region's meteoric rise, and those upon whom the area's future prosperity will depend. Nature canvassed dozens of San Diego insiders to find out who they believed to be the élite. Among the 270 responses, several names cropped up again and again. Although by no means an exhaustive list, here, in no order of merit, are those who were mentioned most often.

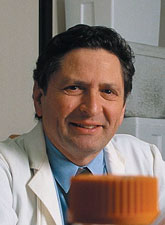

|

Bob Beyster Chief executive of Science Applications International Corporation (SAIC). |

|

|

Howard Birndorf Chief executive of Nanogen, founding partner of Hybritech and IDEC Pharmaceuticals. |

|

|

Bob Conn Partner at the venture-capital firm Enterprise Partners, former dean of the Jacobs School of Engineering at the University of California, San Diego. |

|

|

Ron Evans Professor of molecular biology at the Salk Institute and a Howard Hughes investigator. Founder of several companies including Ligand Pharmaceuticals, Xceptor Therapeutics and Xenopharm. |

|

|